- Reaction score

- 1,004

- Points

- 1,160

Abacus Data Poll: Big Conservative Lead Stabilizes as Evaluations of Trudeau Government Performance Drop - March 10, 2024

From February 29 to March 6, 2024, Abacus Data conducted a national survey of 1,500 adults exploring several topics related to Canadian politics and current events as part of our regular national omnibus surveys.

In this edition of our Canadian politics tracking, we report on our usual metrics along with some updated data comparing perceptions of the Trudeau government’s performance in areas such as housing, healthcare, managing the economy, and managing government finances.

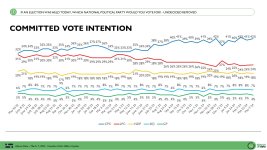

Conservatives lead by 18 over the Liberals. It’s been 658 straight days that the Conservatives have led the Liberals in Abacus Data polling.

If an election were held today, 42% of committed voters would vote Conservatives with the Liberals at 24%, the NDP at 18% and the Greens at 4%. The BQ is at 34% in Quebec.

Since our last survey, the Conservatives are up 1, the Liberals are unchanged, and the NDP is down 1. Since the beginning of the year, we have seen stability in vote intentions with the Conservatives consistently in the low 40s and the Liberals stuck in the low to mid 20s.

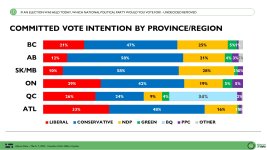

Regionally, the Conservatives are well ahead in the Prairies, lead by 22 in BC, and 13 in Ontario. In Atlantic Canada, the Conservatives are 15-points ahead of the Liberals while in Quebec, the BQ leads by 8 over the Liberals with the Conservatives just two points back and statistically tied with the Liberals for second.

If we isolate British Columbia, Ontario, and Atlantic Canada only, we find the Conservatives holding at 43%, the Liberals up 1 to 27%.

Demographically, the Conservatives lead among all age groups with the Liberal vote share correlated with age. The Liberal vote share rises as the age of the respondent increases. The opposite is true for the NDP.

The Conservatives continue to capture a larger share of the vote among both men and women. Liberal vote share is the same among men and women while the NDP does 9-points better among women than it does among women. For a deep dive on the differences between men and women, check out this analysis by my colleague Oksana Kishchuk released on Friday.

When we ask people if they would consider voting for each of the main political parties, 50% say they are open to voting Conservative (down 2 since earlier this month) while, 39% are open to voting NDP (down 1), and 39% are open to voting Liberal (unchanged) and the lowest we have measured for the Liberals since they were elected in 2015.

We continue to measure voter motivation by political party.

We find that Conservative supporters are more likely to say they would vote than Liberal or NDP supporters. Enthusiasm for voting NDP is down 5 from last month while Liberal enthusiasim is up slightly by 3 points.