McG

Army.ca Legend

- Reaction score

- 2,348

- Points

- 1,160

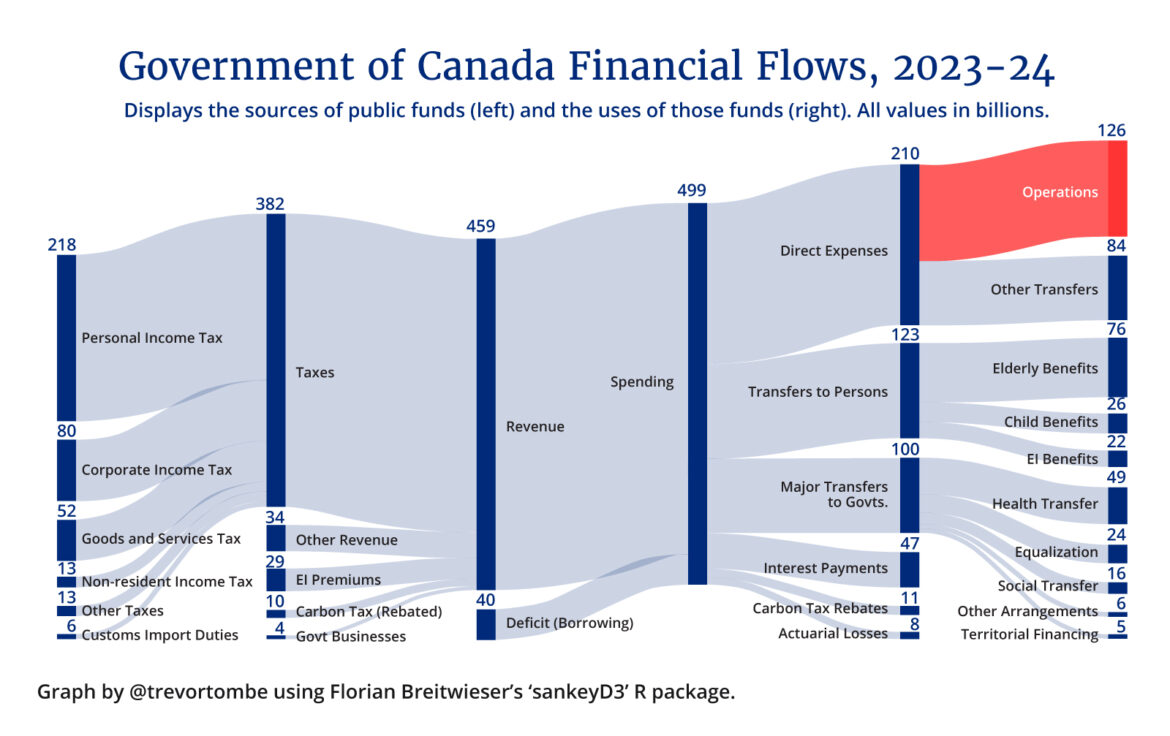

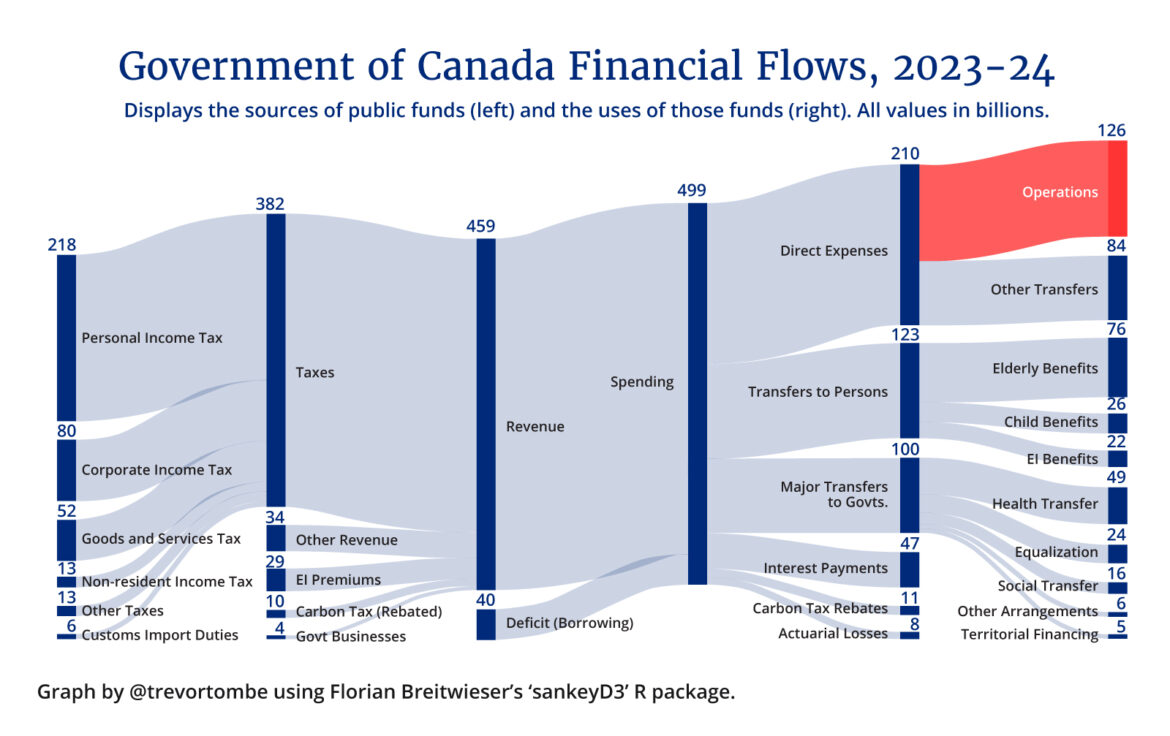

Here’s an idea to ponder.

thehub.ca

And an interesting observation:

thehub.ca

And an interesting observation:

One straightforward way to balance the budget? Cut seniors benefits - The Hub

The federal government plans to spend nearly 24 percent less per person over the next six years. The trouble is, restraining direct federal expenses doesn't get you very far to balancing the budget. Trimming benefits to high-income seniors, however, would.

The trouble is, restraining direct federal expenses doesn’t get you very far.

In fact, you could fire every single federal employee (excluding the military and RCMP) and still come up short!1 You could defund the CBC, privatize Via Rail, eliminate any program with the word climate or energy efficiency in the title, close every single regional economic development agency, and disband the entire Department of Canadian Heritage, and the deficit would be cut by barely more than one-fifth.